VAT recovery

How VAT Recovery Works

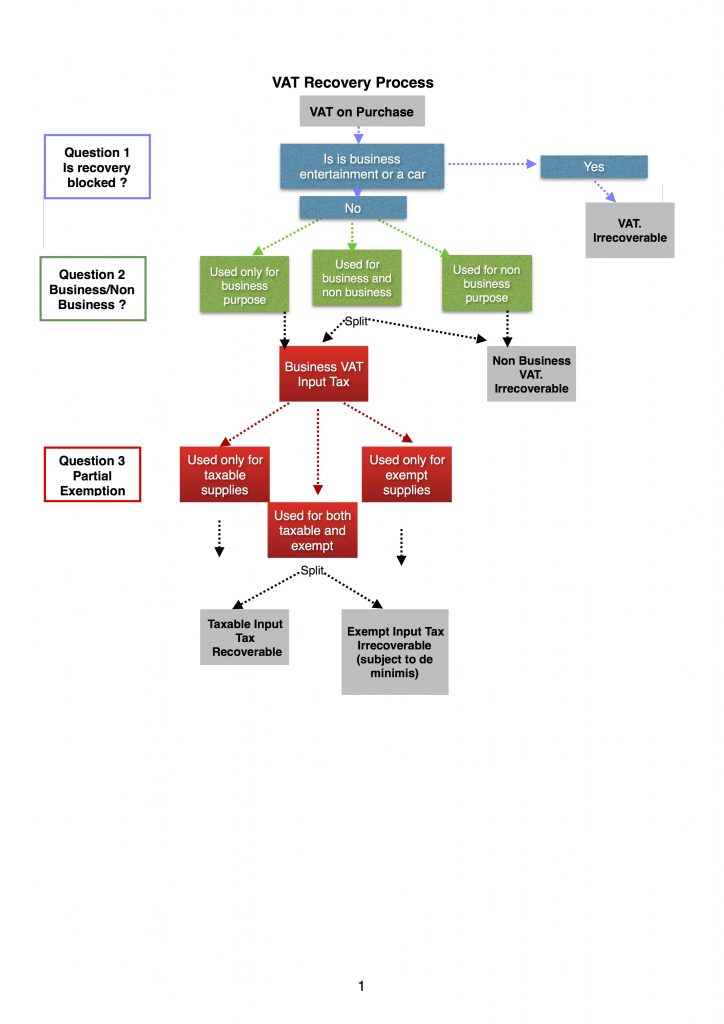

It is easy to get confused over how the VAT recovery rules work. Do not assume that just because a business is VAT registered it can recover all of the VAT it incurs. The VAT recovery rules are a bit more complex than that.

The main principle behind VAT recovery is that VAT incurred on purchases can be recovered if there is an intention to use them to make taxable supplies in the course of business. Taxable supplies will be standard rated (20%), zero rated and reduced (5%) rate. VAT is not recoverable if the purchases are to be used for a non business activity. It is also potentially not recoverable if the business activity involves making supplies the VAT system treats as exempt.

There are some exceptions where the law restricts VAT recovery even if the tax relates to taxable business. You cannot recover the VAT you incur on business entertainment or the purchase of motor cars. This VAT is blocked

It follows that VAT recovery is dependent upon the following three questions .

- Is the VAT incurred on a purchase where the law specially restricts recovery. ie on business entertainment or motor cars.

- Was the purchase brought for the purposes of business

- If it was a for a business purpose does this involve making supplies that the VAT system treats as VAT exempt

Question 1 – Is the VAT Blocked

The VAT system blocks recovery for business entertainment and cars.

The business entertainment block restricts recovery of VAT incurred on providing free hospitality to non employees. So it prevents recovery of corporate hospitality VAT. It does not prevent the recovery of normal subsistence expenditure or VAT incurred on non lavish staff entertainment. The block does not apply to entertainment provided to overseas clients. Here HMRC may insist on a charge to output VAT.

The motor car block is there to tax the private use of motor cars which tend to be used for both private and business journeys. Rather than businesses either apportioning the purchase between private and business use or accounting for output VAT on private use there is a VAT recovery restriction. Since this is worth many billions HMRC are understandably careful to ensure the car VAT rules are correctly applied.

These rules prevent any recovery of VAT charged on new cars that will be available for private use. This covers most vehicles except pool cars and cars intended to hire or demonstration. If you don’t buy a car but lease it then there is a 50% VAT recovery restriction

Question 2 Is the purchase used for business ?

You can only recover VAT on business activities. For most people and organisations that are VAT registered this is not a great problem as they are clearly in business, providing goods and services in return for payment. Non business activities can take two forms, between which the VAT legislation now draws a distinction.

The first is private activities. The fact you are VAT registered doesn’t stop you buying things for private purposes and recovery on these is restricted.

The second is activities that although non private are still non business. This is normally because they don’t involve the making of supplies for payment. For example a charity that is entirely funded by donations and provides free assistance will not be in business.

Mixed Business/Non Business Use

UseIf you use goods and services for both business and non business purposes then you must apply a business/non business apportionment.

There is no set method for carrying out a business/non business apportionment. Any method is acceptable providing it gives a fair and reasonable result. For a business that allows some private use of an asset, such as a van or other equipment a fixed % may be fine. For a charity that undertakes some free and some paid for services a more sophisticated method might be a good idea.

The most common business/non business VAT apportionment method is an income method. This uses outside the scope income as a proxy for non business. If 60% of a charity’s income is outside the scope grants and donations then the method assumes 60% of its activity is non business. If the free non business activities are entirely funded by grant income this can be accurate. But if the grant income partly subsidises charged for services an income method gives a misleading result. A subsidised activity is not necessarily partly non business.

I used to have HMRC policy responsibility for business/non business questions and would be delighted to talk through any issues you have . Contact me here

Question 3 Is the purchase used to make taxable supplies ?

VAT incurred on purchases that is used for a business purpose is then subject to the partial exemption rules.

The partial exemption rules are very specific. You first directly separate your business purpose VAT into one of three catagories.

- Taxable Input Tax (used exclusively to make taxable supplies); or

- Exempt Input Tax (used exclusively in making exempt supplies) or

- Residual Input Tax (used for both taxable and exempt supplies or an overhead).

The residual VAT is then apportioned using a partial exemption method.

Unlike business/non business apportionments where any method is allowed, there is a default partial exemption method. This ‘standard method’ is an income method.

The % of residual VAT that is recoverable ‘taxable input tax” is determined by the calculation.

% = Taxable income/taxable + exempt income.

This figure is then rounded up to the nearest full percentage.

At the end of the partial exemption calculation there will be totals for taxable and exempt input tax. The taxable input tax can be recovered. The exempt input tax is irrecoverable unless it is within the the de minimis limit. This allows you to recover exempt input VAT if it is less than £7,500 a year and less than 50% of total input tax. It is a limit not an allowance. If your exempt input tax is £7,501 you get nothing.

If you make exempt supplies you should consider the partial exemption rules. A good starting point is the HMRC partial exemption notice 706. See here

Improving your VAT Recovery

There are a number of ways that you can improve your VAT recovery. For a few ideas see this article. Improving Recovery