Guide to the Hospice VAT including the Refund Scheme

Guide to the Hospice VAT Refund Scheme

The hospice VAT refund scheme was introduced on 1 April 2015. As VAT advisor to Hospice UK I was involved in the discussions with HMRC as to what form the scheme should take. These are continuing as there are a number of issues still to resolve. The contents of this short guide are based both on these discussions and my work with many hospices clients. Click here for details of my VAT advice for hospices

This is a work in progress. The current version incorporates information received up to 17/5/21. If you have any questions on hospice VAT please give me a call. There’s no charge for an initial chat.

I send out an email newsletter on hospice VAT that can keep you up to date with changes in the specialist VAT rules relating to hospices. If you would like to subscribe then click here

An HMRC guidance note has now been published but it covers all the new refund schemes, including the rescue charities. HMRC Hospice Refund Notice A more detailed ‘official’ guidance note will hopefully be released as part of the joint HMRC/ Hospice UK VAT guidance project.

The scope of the refund scheme

The refund was introduced on 1 April 2015. It applies to all VAT incurred on non-business activities undertaken by a palliative care charity. This is essentially a hospice charity.

Trading subsidiaries are not able to obtain a refund under the scheme even if they undertake non-business activities.

VAT groups are permitted but the refund will still only apply to the non-business activities of the charity.

What is a palliative care charity?

Palliative care charities are defined as charities having as their main purpose the provision of palliative care. This is care that is either doctor or nurse supervised and provided to persons with a terminal illness. The refund is designed to apply to what are usually called hospices. It is not designed to apply to care homes or other bodies that provide palliative care as part of their wider activities.

The use of the term ‘Palliative care charity’ rather than hospice has led to some confusion. Palliative Care Charity was used instead of ‘hospice’ as the lawyer who drafted the law felt that the term ‘hospice’ might be seen by some as limiting the refund. The concern was that a reference to ‘hospices’ might have implied residential palliative care and excluded hospice at home or outpatient services.

The use of the phrase ‘terminal illness has led to concerns as it implies death within a relatively short time frame. In fact, 6 months is used in other legislation. This has led to fears that children’s hospices in particular, which care for children over a far longer period, will be excluded. HMRC has given assurance that these fears are unfounded. For VAT purposes ‘terminal illness’ has no time limit.

Although the term hospice is not used, the refund is designed to apply to all hospice charities.

What is the main purpose of a hospice?

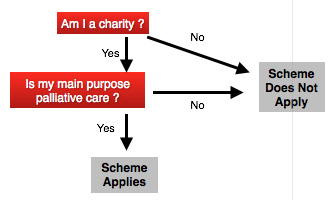

The refund will only apply to charities that have the main purpose of providing palliative care. This means that the refund will not apply if :

If the refund will not apply because you are not a charity. This causes problems for Community Interest Companies (CIC) which will need to establish a charity to use the scheme.

When judging if a charity has palliative care as its main purpose, HMRC will first look to a charities objects and then to what it actually does

Hospices with more than one activity

Determining the main purpose

HMRC expect hospice charities to consider all possible indicators when deciding their main purpose.

Indicators of ‘main purpose’ a charity should consider, in my view, include :

- Objects – is the provision of palliative care the first object or given prominence?

- Income – assuming the other services are self-funding who much do they generate relative to the palliative care activity?

- Expenditure – what is the balance of expenditure between palliative care and non-palliative care activity?

- Staff Time – how much staff time is spent on non-palliative care?

If all these indicators show the palliative care service is the most important object then there is no issue. If they do not then it would be worth taking advice. You might seek an HMRC ruling and/or possibly restructuring.

What is non-business for the Refund Scheme?

The refund applies to VAT incurred on a non-business activity. This will generally be an activity that does not involve making a charge but which is funded entirely by grant, donation or internal funds. This means that activities other than palliative care will be included in the refund if they are non-business. This might include providing free community services, fund-raising activities or anything you do for free.

Of course, the most important question for a hospice is whether its palliative care work is non-business. There are two key questions.

1 – Is it funded under an agreement that HMRC regard as payment for a supply of services.

2 – If it is a supply of services is this non-business because of the concession applied to subsidised welfare activities.

The Treatment of Palliative Care Funding Agreements

HMRC accept that funds provided under the standard NHS funding agreements for England, Wales, Scotland and Northern Ireland are outside the scope of UK VAT.

They take this view because the agreements do not specify individual patient names or care plans or allow the funding bodies to specify those in the future. They are general agreements concerned with general outcomes. The activity is non-business.

A hospice or the funding body may seek to amend these agreements or the schedules so that named individuals receive specified services. This is certainly the policy direction of travel in large parts of the country. In this area be very careful as HMRC may no longer regard such funding as outside the scope. It may be seen as payment for an exempt supply and restrict VAT recovery under the refund scheme.

The Concession for Subsidised Welfare Activities.

Where care is provided under personal budget contracts then HMRC sees that a supply is made to the person receiving care. This is perhaps arguable and recent VAT Tribunals have expressed unease at the policy (e.g. ). This will also be true of care where the patient pays directly. In both cases, the supplies fall under the VAT welfare exemption and possibly other exemptions too. Yet when such a supply is subsidised by more than 15% then the activity can be treated as non-business. This under the extra-statutory concession that applies to subsidised welfare services. See Para 5.18.2 in the VAT Charities notice. See https://www.gov.uk/government/publications/vat-notice-7011-charities/vat-notice-7011-charities#deciding-whether-your-activities-are-business-or-non-business

Continuing Care Funding

Some funding already specifies patients or treatments. Examples include Personal Budget contracts or Continuing Care agreements.

HMRC’s former policy was to see such money as payment for an exempt supply and a business activity. i.e. not in the refund scheme.

HMRC now accept (29/11/18) that this funding is outside the scope of VAT. Details of the reasoning behind this welcome change have yet to be given. The statement from David Gaskell, the main Officer for hospices reads ‘ Policy have confirmed to me that it is their position that continuing care contracts between hospices and CCGs are now viewed as not being a business activity and therefore outside the scope of VAT’.

COVID Support

HMRC have confirmed that the Government support to the hospice sector provided to make up potential shortfalls in funding as a result of COVID is outside the scope pf VAT. If you are ever challenged on this and need a copy of the letter from Policy let me know.

Colchester FE Case and the treatment of Hospice Funding

In early 2021 the Upper VAT Tribunal gave a well-argued judgment in an appeal concerning Colchester FE College. It was concerned with a very unusual set of circumstances where it was in the interest of the College to argue it made VAT exempt supplies by way of business. In common with all FE Colleges, the College’s Government funding had always been treated as outside the scope and this had the consequence that it was mainly engaged in non-business activities. The Court disagreed and found that there was a sufficient link between the funding and the services provided for it to be regarded as payment for these services with the consequence that the College was engaged in business activities. The fact that the funding wasn’t for specific individuals didn’t matter. Understandably some advisors have seen similarities with hospice funding arrangements and raised concerns that hospice funding streams that are currently treated as outside the scope are in fact exempt income.

Although these concerns are understandable, the case does not mean that the treatments I describe above have changed or are at any serious risk of changing in the near future. The nature of hospice funding is rather different and can be distinguished. FE Colleges receive almost all of their funding from Government sources whereas hospices only a minority. If HMRC were to adopt a new policy for hospices then they would have had to do so with a far wider range of organisations. It would be hard to see how they could exclude Academy schools from the change for example and treating them as engaged in business would essentially prevent the state school sector from obtaining VAT recovery. So there are far wider policy implications of any change which mean HMRC will be reluctant to make policy changes without a lot of thought. If they are forced to change their view of such funding I suspect it will be a change accompanied by further legislation to protect bodies such as Schools and Hospices that must be seen to be engaged in non-business activities.

This is not just wishful thinking on my part as HMRC VAT Policy has confirmed (17 May 21) that they have not changed their view of hospice funding based on the Colchester case.

What non-business VAT does the scheme cover?

The refund covers all VAT that relates to the non-business activities of a palliative care charity. That means it includes capital works, overheads, temporary staff and hire of equipment – all non-business VAT. There has been some misunderstanding about this but it does really cover all VAT – including capital works. So if you build an extension to your hospice you can recover the VAT under the scheme.

The VAT must be incurred by the charity. This means there will be invoices made out to it which relate to goods and services it buys for its non-business purposes. Invoices made out to trading subsidiaries are not included. So hospices with multiple legal entities should be careful that the correct legal entity gets the invoice and pays.

How to calculate the refund

Hospices should record all of the VAT incurred on goods and services that exclusively relates to their non-business activity.

For the VAT to be recoverable it must be properly incurred. This means that, if for example, a supply of construction services should have been zero-rated then it isn’t recoverable. The new refund scheme does not alter the VAT liability of supplies made a hospice. If they were zero-rated before 1 April 2015 then they still are now.

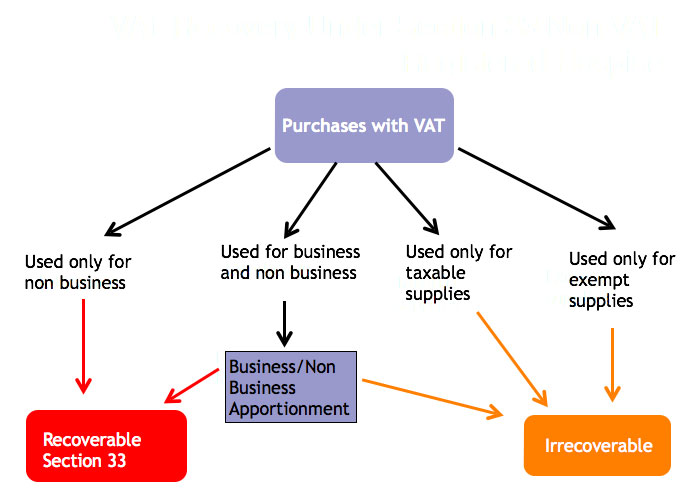

Where VAT relates to both non-business and business activities then it must be apportioned. VAT that relates to non-business is recoverable under the refund. VAT that relates to business activity is potentially recoverable under the normal VAT rules.

Even if some palliative care is regarded as business, some elements of care may be wholly non-business. For example, an adult hospice might provide alternative therapies, bereavement counselling or home support and not have these included in any contract i.e. they are wholly funded by self-generated funds. A children’s hospice might provide play opportunities or a toy library. For these non-business activities, there is no apportionment. The VAT incurred is wholly recoverable under the refund scheme.

Business/Non-Business Apportionments

A Business/non-business apportionment must be fair and reasonable. What form it takes is completely up to you. There is no set method.

Although there is no obligation to get HMRC to agree on a method, it is good practice to do so. This is particularly true if you depart from an income-based approach to something more unusual. HMRC have allocated Charity Officers that deal with the refund scheme. They can comment on your method. They do not normally insist on a joint special business/non-business and PE method being submitted.

Business/non-business refund methods in place before 1 April 15 may need revising. These were sometimes designed to maximise the amount of business a hospice was seen to have. For example, income methods included modifications that reduced the amount of outside the scope income included in the calculation. This increased the business % which was useful before April 15 but is now detrimental.

Income Methods

Income methods assume that the amount of outside the scope income is a good indication of non-business activity. This can give a misleading result if activities subsidise each other. Assume a charity operates 30 hospice shops which generate 50% of its income. Does this really mean that it uses 50% of its overheads for this business? Other methods such as staff time or area methods are often more accurate. But my experience is that in practice income methods are often adequate. This may be because the amount of VAT that must be apportioned is minimal. Alternatively, the hospice is de minimis for partial exemption purposes and can recover all of its VAT. But I would expect most hospices to be at least 90% non-business. If you are less than that something may be wrong.

Choosing the best business/non-business method

It is important that all hospices consider if their business/non-business method is appropriate. A VAT advisor that is experienced in charities (i.e. knows the distinction between non-business and exempt) will be able to advise and help you model how the refund will work. I will be delighted to help – see the section on my website explaining my experience.

Regardless of who you use I would recommend you consider taking advice. The refund scheme is likely to result in your recovering tens or hundreds of thousands and paying a few thousand to ensure you maximise recovery is sensible.

Should a hospice VAT register or not?

Hospices that are not VAT registered can use the refund scheme. They make a claim this using a VAT 126 form. HMRC have indicated they have no preference towards a hospice recovering VAT using a VAT registration as opposed to a 126 form. In practice, most hospices make some taxable supplies and are allowed to VAT register. This means smaller hospices can often choose either route

A new VAT group registration is an alternative to a single charity only VAT registration. This is possible for a non VAT registered hospice with trading subsidiaries.

If you have been granted permission not to VAT register

If you exceed the VAT registration limit you must normally register for VAT. However, if you will be in a repayment position then HMRC can permit you to remain unregistered. Where a hospice is in this position then it must now register for VAT. It cannot make a 126 claim.

How the refund works for a Non-VAT registered hospice

A non VAT registered hospice can only recover VAT using the refund scheme. Any VAT incurred on purchases used to undertake business supplies, be they taxable or exempt for VAT purposes is irrecoverable.

In this sense, the hospice refund scheme is less generous than the local authority scheme where non VAT registered local authorities can also recover VAT which relates to exempt supplies.

A non VAT registered hospice may also have some business activities such as a lottery or other fundraising events. It will therefore still need to apply a business/non-business apportionment to the VAT it incurs on its overhead expenditure.

Obtaining a 126 Form

Non VAT registered hospices will not automatically be sent a VAT 126 claim form by HMRC. Instead, they must initiate the claim themselves.

A VAT 126 claim can be made for a minimum period of one month. 12 months if it is for less than £100. It must be made within 3 years of the end of the month in which the earliest VAT being claimed was incurred. All supporting documents must be retained for at least 6 years. The 126 forms can now be submitted electronically.

Completing a VAT 126 claim

A non VAT registered hospice applies for a refund using a VAT 126 form. Accompanying this form you will have to provide details of the VAT you can recover. The requirements for a 126 claim do exceed those for a normal VAT registration in that HMRC require that a claim includes the following:

– Invoice date

– Suppliers VAT number

– Description of supply

– Addressee

– VAT paid

Under normal VAT accounting, you do not need to record the supplier VAT number or include a supply description. In practice, most systems such as SAGE can cope with preparing suitable reports. If you have difficulty then get in touch and I can point you towards people who can help.

These 126 requirements were relaxed for Academy School claims a few years ago. I understand that HMRC is looking into whether they can be for hospices as well. It is to be hoped they can be. But for now, if you submit a 126 claim with insufficient information do not be surprised if HMRC rejects it.

The reason for HMRC requiring so much detail is that a 126 claim is not like a VAT return that they can adjust later. Once they pay it they cannot easily revisit it. This is an advantage of the 126 route. But HMRC is looking to harmonise their powers over both mechanisms. It may therefore be a short-lived benefit.

How The Refund Works For a VAT Registered Hospice

A VAT registered hospice can recover all of the VAT it incurs that relates exclusively to its non-business activities. Where it incurs VAT that relates to both its non-business and business activities this will need to be apportioned. The element that relates to non-business can be recovered using the new refund scheme. The element that rates to business must then be recovered according to the normal VAT rules.

The VAT that relates to a business purpose is technically called input tax. If the hospice makes exempt supplies then this tax will be recovered in accordance with the partial exemption rules.

Partial Exemption

The partial exemption rules require that input VAT first be sorted or ‘directly attributed’. It must be separated into three categories – taxable, exempt and mixed-use (called residual). The residual VAT is then split so that part is treated as taxable and part exempt. This split is done using a partial exemption calculation.

There is no special method for VAT recovery or special de minimis limit. The standard partial exemption method applies unless HMRC gives it for a special method.

The standard method calculation is :

Residual recovery % = Taxable Income

Taxable Income + Exempt Income.

The residual input tax is split using this formula. After this, there will be two totals. A total for taxable input tax and a total for exempt input tax.

The taxable input tax is added to the non-business VAT and recovered. Both are treated as input tax on the VAT return.

The exempt Input VAT may still be recoverable if it is within the de minimis limits. These allow recovery of exempt VAT if it is. 1) Less than £7500 a year and (2) less than 50% of total input tax. I have more on de minimis in my guide top VAT Recovery

A VAT registered hospice is likely to undertake both business/non-business and partial exemption apportionments.

How Much VAT Recovery should a Hospice be Getting?

The amount will depend upon what is done and the legal structure. Hospice charities will often be over 90% non-business but this can be reduced if they operate either their shops or lottery from within the charity. My experience is that 50% + is a normal partial exemption percentage for a hospice. This means that an overall recovery of between 90 – 95% of overhead VAT is normal.

Is one overhead category enough?

Both the business/non-business and partial exemption apportionments require VAT to be sorted or ‘attributed’. This process decides what VAT is fully recoverable and what must be apportioned. Yet VAT that needs to apportioned under the business non-business rules may not also need to be apportioned under the partial exemption rules. For example, assume a hospice provides catering to its non-business patients for free and also to staff and visitors for a charge. If it was to purchase kitchen equipment then this VAT would relate to both non-business palliative care and a business activity. It would therefore be apportioned under the business/non-business rules. But the business activity, the selling of catering, would be wholly taxable. If this VAT was also included in the partial exemption calculation there would be under recovery. This is an example of the danger of using a single residual category.

Another example is a hospice shop. If a charity has a shop that it also uses to sell lottery tickets from an in-house lottery then it makes exempt supplies. As the shop makes both taxable and exempt supplies the VAT it incurs on costs must be apportioned under the partial exemption rules. But it is still all used for business and it would be wrong to also apply a business/non-business apportionment.

There are in fact 7 possible direct attributions. Whether it is necessary to go into such detail will depend on the size and complexity of the hospice.

VAT Groups and the Scheme

There has been some confusion over the application to VAT groups. The scheme only applies to charities. This means that when a hospice charity is grouped with trading subsidiaries that the refund doesn’t apply to the subsidiaries. Non-business activities undertaken by the trading subsidiaries (unlikely but known) will result in a VAT recovery restriction.

The business/non-business method should be undertaken with reference to the hospice charity. If an income method is used it would not therefore normally include trading subsidiary income.

The partial exemption calculation must be calculated using the income of the entire VAT group. This is required in the VAT legislation.

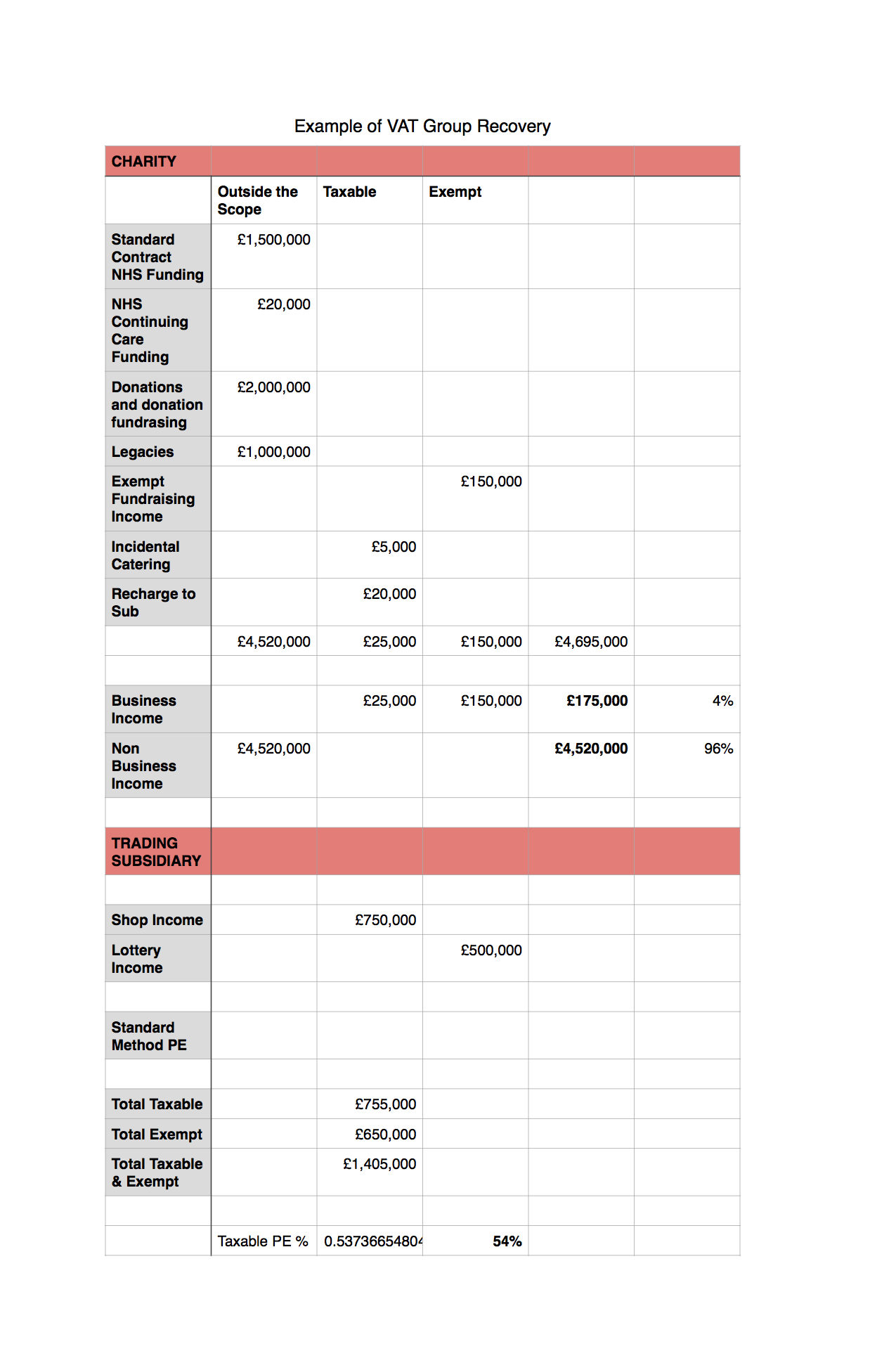

Example of Hospice VAT Group Recovery

In this example, 96% of the charity’s income is outside the scope. This means its use of overheads is 96% non-business under a basic income method.

The partial exemption calculation is then calculated using the income of the whole VAT group. This gives in 54% recovery. i.e. 54% of the business VAT is used to make taxable supplies.

If VAT is incurred on a general overhead then 96% will be recoverable under the refund scheme. This relates to non-business.

The remaining 4% relates to business VAT is apportioned by the partial exemption calculation. 54% of this will be recoverable.

This means that the hospice will recover 98% of the VAT it incurs on a general overhead cost. There is not much need for a special method here. In fact, it is likely that the hospice will be de minimis for partial exemption. It will then obtain full VAT recovery.

Fundraising and the Refund Scheme

If you charge to participate in a fundraising event it is a business activity for VAT. Although the charges are likely to be VAT exempt under the VAT fund-raising exemption. The VAT incurred on organising such events is not within the hospice refund scheme.

If you organise a fundraising event that does not involve making any charges but relies on donations this is non-business. This event is within the hospice refund scheme.

If you organise an event that involves charges and donations then HMRC sees it as wholly business. They do not believe that any part of the VAT is recoverable within the refund scheme. This is perhaps arguable but is consistent with their normal approach. For example, if before the scheme was introduced a hospice charity that was de minimis was told it had to apply a non-business apportionment to a fund-raising cost because it obtained donations it would not have been happy. If you are considering whether to make a charge for an event it is worth factoring in the VAT consequences.

The Capital Goods Scheme and the Hospice VAT Refund

HMRC accept that the scheme applies to capital items that were created after the introduction of the refund in April 2015. For example, assume you built an extension in June 2015 and recovered 93% of the VAT. If in the 2016 VAT year your recovery was to rise to 95% there would be a positive CGS adjustment.

What HMRC cannot accept is that the CGS can adjust VAT recovered before the scheme using the recovery calculated post scheme. For example if you built an extension in March 2014 when your recovery was 20% you cannot recover additional VAT on that work via the CGS now your recovery is 91%.

The HMRC position does mean that there are potential opportunities for hospices that register for VAT after the introduction of the scheme. If you contact me I can elaborate.

Summary of the VAT Treatment of Common Hospice Activities

| Activity | Note | Business? | VAT Liability |

NHS Funded Palliative Care |

Self-funded or under NHS standard terms non- patient specific | No | None |

Continuing Health Care Funded Palliative Care |

Patient-Specific Continuing Health Care | Yes | Exempt |

Spot Purchase Palliative Care |

Spot Purchase | Yes | Exempt |

Purchased Palliative Care |

User purchased or personal care budget | Prob no under concession | None |

Training and Education |

For other institutions and care homes | Prob yes | Exempt or standard rated. Depends on if hospice an eligible body |

Chaplain Fees |

For running funeral service | No | None |

Cremation Certificate Fees |

For signing certificates | Yes | Exempt |

Catering |

For staff and visitors | Yes | Standard rated. Pos some zero rated |

Own Lottery Income |

Own lottery | Yes | Exempt |

3rd Party Lottery Income |

3rd Party Lottery | No | None |

Retail sale of donated goods |

Sales donated goods | Yes | Zero rate |

Retail gift aid sales |

Under gift aid scheme | Yes if commission charged | Donation outside the scope |

Supplies of Staff |

e.g. consultants to a local hospital | Arguable. HMRC say yes | HMRC say taxable. Prob correctly exempt |

Fundraising Event Donation Only |

Donation Only | No | None |

Fundraising Event Donation and Charge |

Donation plus charge | Yes | Exempt |

Fundraising Event and Charge |

Donation plus charge with Zero rated sale | Yes | Exempt and zero rated |

Fundraising Event Third Party |

Entry to third party event e.g. marathon | Yes if a charge made | Standard rated

|

Hospice Construction VAT Zero Rating

A VAT zero rate applies to the construction of new hospices that contain at least one bed. These can be seen as a ‘relevant residential building’. This was an HMRC policy change. See here

The zero rate does not apply to extensions and repairs but the hospice refund scheme does. However, be careful using the refund scheme to claim VAT that should not have been charged. If for example you are charged VAT on a new hospice building that should have been zero-rated then HMRC could refuse the refund.

Other Information Sources

I publish an occasional newsletter with hospice VAT information. See Hospice Newsletters

Hospice UK have a useful Q&A on the VAT rules which can be found here

VAT Advice

If you would like to discuss the VAT rules for hospices then get in touch. I am of course happy to informally chat through any issues you might have if you Contact Me

If you would like to see what my clients say about me then see here

Note: This guide constitutes a personal view. It contains general information and does not constitute tax advice. If you want me to give binding specific advice then you need to be a client.